|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Latest Press Releases Employment Solicitors |

|

||||||

|---|---|---|---|---|---|---|---|

David Beckham - a victim of age discrimination? Fabio Capello stunned many with his comments that David Beckham is now too wrinkled for international soccer and is probably not going to be selected for the Britain side again, but is Beckham in reality a victim of age discrimination? Capello made the comments to writers before England's friendly match against Hungary when queried on the possibility of Beckham returning to the Britain team. Irrespective of the footballing discussion, this raises issues in the sphere of discrimination and Forbes solicitors has spoken out caution companies of the hazards of discriminating workers, Britain footballers or not, on the grounds of their age. Jonathan Holden, Work Law expert at Forbes solicitors comments : Each employer has a legal responsibility not to be prejudiced against employees and workers on grounds of age. In that particular situation, failing to choose somebody on grounds of age may be possibly discriminatory. The sole defence to such a claim would be for the employer to show that this is often impassively justified. In that circumstance the employer would thus have to show the choice of players on grounds of age was a bonafide system of producing slightly more favourable results. But in practice this is often extremely tricky to do. While it is improbable that any soccer player would bring a claim on grounds of age, this nevertheless illuminates the potential problems open to companies. Compensation for discrimination claims is unlimited and thus it's really important that all bosses are conscious of their rights and responsibilities in this complex area.

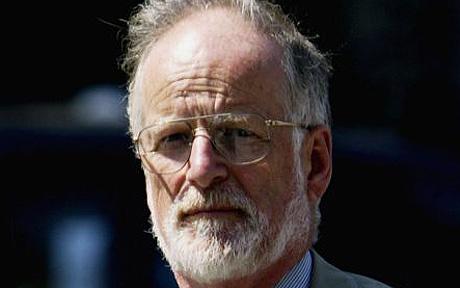

Replenished calls for a full coroner's inquest into the demise of Dr David Kelly, the weapons expert who criticized the legitimacy of Alistair Campbell's dodgy dossier, remind me of a question the Hutton investigation never addressed and one obscure way in which public sector annuities are more dangerous than others. Unlike staff in the non-public sector, civil servants and members of the Armed Forces can be stripped of all retirement benefits by their employer. Bosses in the private area have no such power. Dr Kelly, 59, was one year short of the standard retirement age for civil servants when he died, as I illuminated in this space seven years back. Therefore as one fiscal advisor put it : Any threat to his annuity at that stage would've been a fatal blow from which there wasn't any hope of recovery. Lord Hutton's investigation inspected what was declared to Dr Kelly when he was interviewed by Ministry of Defence police after he was identified as a critic of Govt policy. Nevertheless it never asked any questions about if this family man on the cusp of retirement was threatened with the loss of his allowance. When I put this query to the Cupboard Office in July, 2003, it declined to respond to any questions about whether Dr Kelly was told his annuity might be lost. But a Ministry of Defence spokesman told me : the size of disciplinary action was that he was reminded he had unapproved contact with a correspondent but he wasn't threatened with loss of his annuity or the Official Methods Act. We aren't prepared to chat about any farther facets of the circumstances surrounding Dr Kelly's death. Precisely what was asserted to Dr Kelly by Ministry of Defence police while he was lodged in a safe house, waiting for his interview by the House of Commons foreign affairs select committee, may never be known.

What's clear is that no threat of disciplinary action against Dr Kelly, including dismissal, might have cost him or his widow as much in money terms as the loss of his pension. Philip Rose, of independent money advisors and retirement experts Wentworth Rose now part of Origen announced at the time : Any threat of loss of income or demotion would be a relatively small issue for a person of 59 years old compared with the awful blow of being told his annuity was at risk. Any threat to his annuity at that stage would've been a fatal blow from which there wasn't any hope of recovery. The Ministry of Defence declined to say what Dr Kelly's Civil Service grade was or how many years he had gave to the Principal Civil Service Annuity Scheme ( PCSPS ). However, had the senior weapons expert been paid £45,000 his yearly annuity after twenty years' service would've been £11,250 with a £33,750 money one-off sum. Because Civil Service allowances are index-linked, it might cost more than £352,000 to buy the same benefits in the private area from Britain's largest insurer, Prudential. Against that, the Forfeiture Act 1870, one of the oldest ordinances still in force, permits all entitlement to PCSPS advantages to be withdrawn in certain circumstances. The PCSPS deeds state : The Minister will have power to withhold benefits owing under this plan where a civil servant or previous civil servant is found guilty of an offence in association with any work to which this project applies, being an offence which is warranted by a Minister of the Crown either to once have been gravely damaging to the state or to be responsible to cause significant lack of confidence in the general public service. John Pearson, an annuities expert at Town solicitors Lovells now Hogan Lovells related at the time : there are more powers to withhold allowance benefits available to the Minister for the Civil Service. As an example, benefits may be withheld where the scheme member is found guilty of betrayal or offences under the Official Strategies Acts 1911 to 1989 and is given imprisonment for no less than ten years. Nonetheless before benefits might be forfeited, the individual worried has entitlement to appeal to an independent board designated by the Minister and he's going to accept the board's judgment on whether the appellant's allowance should be forfeited. David Astley of the nation's organisation of Annuity Funds stressed that non-public sector companies have no such wide-ranging rights to sequester an employee's annuity. Nonetheless he added that there's one exception : whether or not you are in a last income or a money purchase scheme in the private area, the sole way an employer can withhold annuity rights is if you have committed crime or caused loss to the employer and there's no way for the company to recover the debt, apart from going after your annuity. Even then, the curators would need court approval before they could reduce a member's benefits by the quantity of a total debt. This wouldn't be an easy plan and it'd even be required for the curators to find HM Income & Custom's approval this wouldn't bias the scheme's tax exempt standing. For all of these reasons, it is very peculiar in the personal sector for an employer to go after an employee's allowance. In seventeen years in the insurance industry, I only found one case where curators considered doing so and I don't believe they went forward with the idea. against this, hounding the annuity as a type of punishment does happen in the general public sector. One week after my report appeared in July, 2003, Dorchester Crown Court heard a retired military major would lose his allowance after pleading guilty to running a brothel and living off unethical earnings. Even though it might appear unlikely that anybody would take such extreme action over the loss of their allowance, intense monetary pressures regularly make a contribution to suicide as sad cases often demonstrate. And, as Dr Kelly would have known, his dying was a method to make sure the MOD could never take his widow's benefits away.

|

Liverpool Areas A |

Thomas Street |

|||||

Liverpool Solicitors | Site Map | Resources | Home

©2010 liverpoolSolicitors.co.uk All rights reserved.